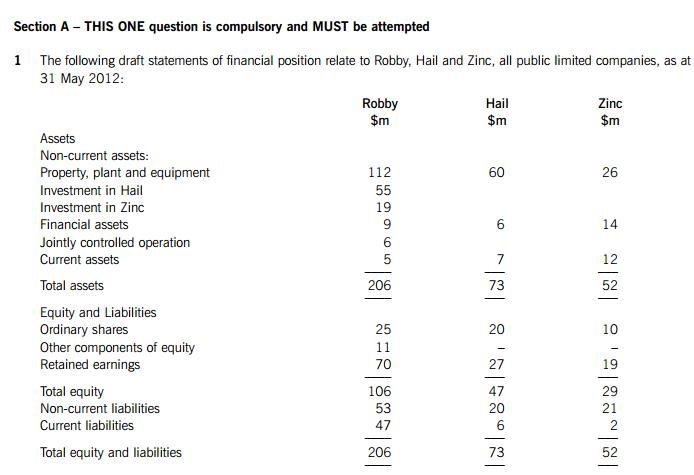

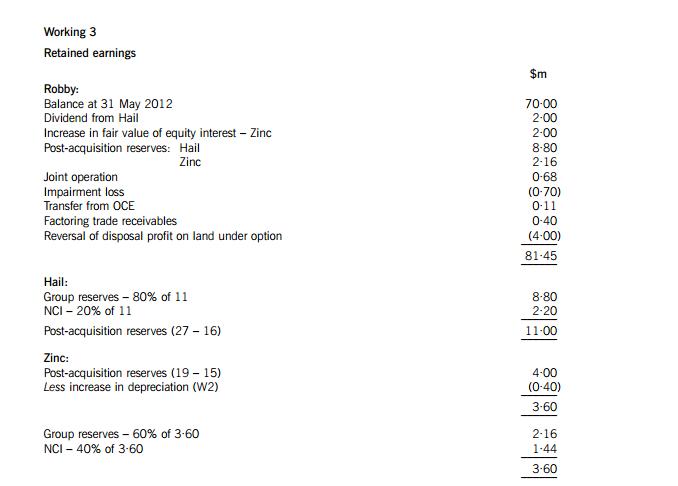

The following information needs to be taken into account in the preparation of the group financial statements of Robby:

(i) On 1 June 2010, Robby acquired 80% of the equity interests of Hail. The purchase consideration comprised

cash of $50 million. Robby has treated the investment in Hail at fair value through other comprehensive income

(OCI).

A dividend received from Hail on 1 January 2012 of $2 million has similarly been credited to OCI.

It is Robby’s policy to measure the non-controlling interest at fair value and this was $15 million on 1 June 2010.

On 1 June 2010, the fair value of the identifiable net assets of Hail were $60 million and the retained earnings

of Hail were $16 million. The excess of the fair value of the net assets is due to an increase in the value of

non-depreciable land.

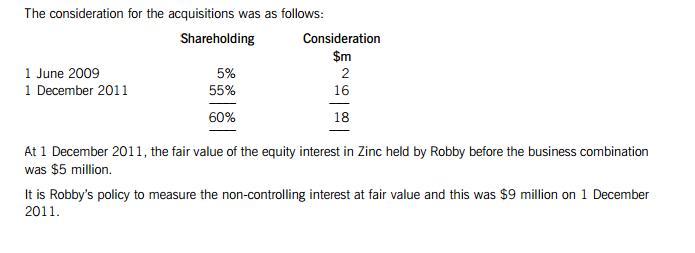

(ii) On 1 June 2009, Robby acquired 5% of the ordinary shares of Zinc. Robby had treated this investment at fair

value through profit or loss in the financial statements to 31 May 2011.

On 1 December 2011, Robby acquired a further 55% of the ordinary shares of Zinc and gained control of the

company

The fair value of the identifiable net assets at 1 December 2011 of Zinc was $26 million, and the retained

earnings were $15 million. The excess of the fair value of the net assets is due to an increase in the value of

property, plant and equipment (PPE), which was provisional pending receipt of the final valuations. These

valuations were received on 1 March 2012 and resulted in an additional increase of $3 million in the fair value

of PPE at the date of acquisition. This increase does not affect the fair value of the non-controlling interest at

acquisition. PPE is to be depreciated on the straight-line basis over a remaining period of five years.

(iii) Robby has a 40% share of a joint operation, a natural gas station. Assets, liabilities, revenue and costs are

apportioned on the basis of shareholding.

The following information relates to the joint arrangement activities:

The natural gas station cost $15 million to construct and was completed on 1 June 2011 and is to be

dismantled at the end of its life of 10 years. The present value of this dismantling cost to the joint

arrangement at 1 June 2011, using a discount rate of 5%, was $2 million.

In the year, gas with a direct cost of $16 million was sold for $20 million. Additionally, the joint arrangement

incurred operating costs of $05 million during the year.

Robby has only contributed and accounted for its share of the construction cost, paying $6 million. The revenue

and costs are receivable and payable by the other joint operator who settles amounts outstanding with Robby

after the year end.

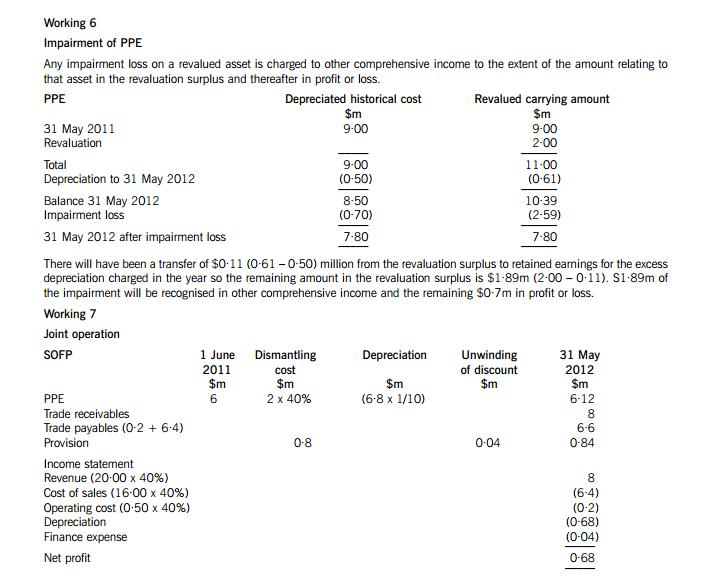

(iv) Robby purchased PPE for $10 million on 1 June 2009. It has an expected useful life of 20 years and is

depreciated on the straight-line method. On 31 May 2011, the PPE was revalued to $11 million. At 31 May

2012, impairment indicators triggered an impairment review of the PPE. The recoverable amount of the PPE was

$78 million. The only accounting entry posted for the year to 31 May 2012 was to account for the depreciation

based on the revalued amount as at 31 May 2011. Robby’s accounting policy is to make a transfer of the excess

depreciation arising on the revaluation of PPE.

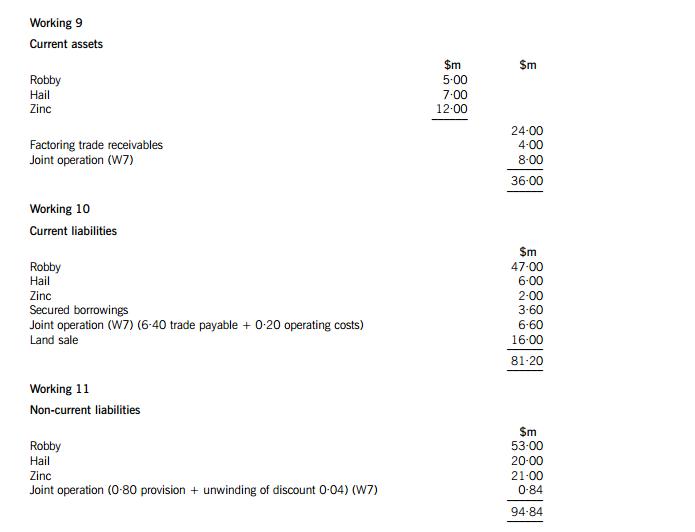

(v) Robby held a portfolio of trade receivables with a carrying amount of $4 million at 31 May 2012. At that date,

the entity entered into a factoring agreement with a bank, whereby it transfers the receivables in exchange for

$36 million in cash. Robby has agreed to reimburse the factor for any shortfall between the amount collected

and $36 million. Once the receivables have been collected, any amounts above $36 million, less interest on

this amount, will be repaid to Robby. Robby has derecognised the receivables and charged $04 million as a loss

to profit or loss.

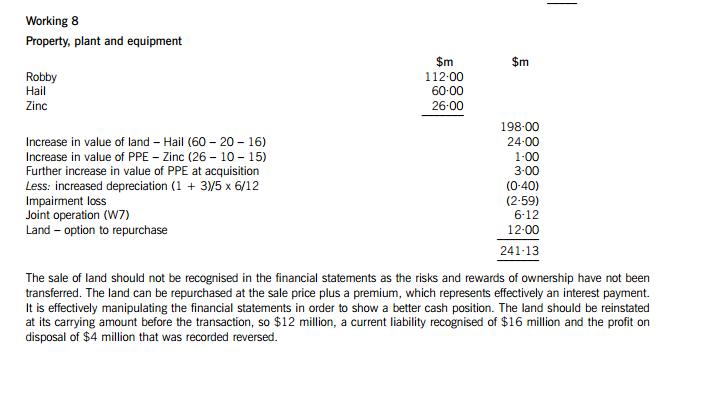

(vi) Immediately prior to the year end, Robby sold land to a third party at a price of $16 million with an option to

purchase the land back on 1 July 2012 for $16 million plus a premium of 3%. The market value of the land is

$25 million on 31 May 2012 and the carrying amount was $12 million. Robby accounted for the sale,

consequently eliminating the bank overdraft at 31 May 2012.

Required:

(a) Prepare a consolidated statement of financial position of the Robby Group at 31 May 2012 in accordance

with Hong Kong Financial Reporting Standards. (35 marks)

3 [P.T.O.(b) (i) In the above scenario (information point (v)), Robby holds a portfolio of trade receivables and enters into a

factoring agreement with a bank, whereby it transfers the receivables in exchange for cash. Robby

additionally agreed to other terms with the bank as regards any collection shortfall and repayment of any

monies to Robby. Robby derecognised the receivables. This is an example of the type of complex transaction

that can arise out of normal terms of trade. The rules regarding derecognition are quite complex and are

often not understood by entities.

Describe the rules of HKFRS 9 Financial Instruments relating to the derecognition of a financial asset

and how these rules affect the treatment of the portfolio of trade receivables in Robby’s financial

statements. (9 marks)

(ii) Discuss the legitimacy of Robby selling land just prior to the year end in order to show a better liquidity

position for the group and whether this transaction is consistent with an accountant’s responsibilities to

users of financial statements.

Note: Your answer should include reference to the above scenario. (6 marks)

(50 marks)

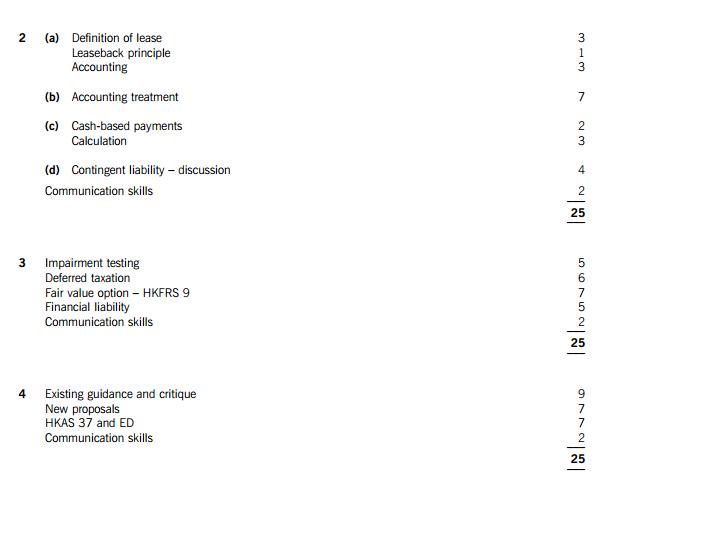

4Section B TWO questions ONLY to be attempted

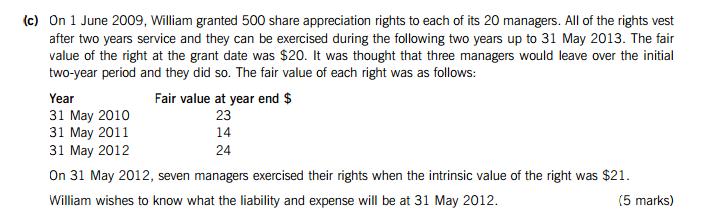

2 William is a public limited company and would like advice in relation to the following transactions.

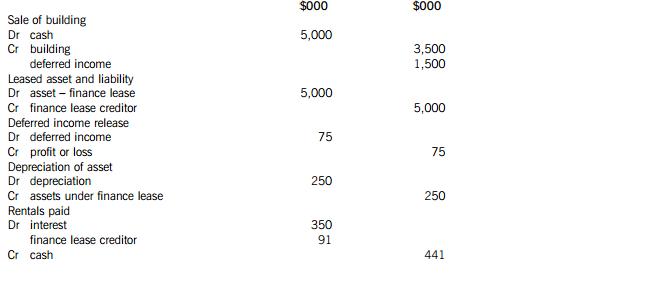

(a) William owned a building on which it raised finance. William sold the building for $5 million to a finance

company on 1 June 2011 when the carrying amount was $35 million. The same building was leased back from

the finance company for a period of 20 years, which was felt to be equivalent to the majority of the asset’s

economic life. The lease rentals for the period are $441,000 payable annually in arrears. The interest rate implicit

in the lease is 7%. The present value of the minimum lease payments is the same as the sale proceeds.

William wishes to know how to account for the above transaction for the year ended 31 May 2012.

(7 marks)

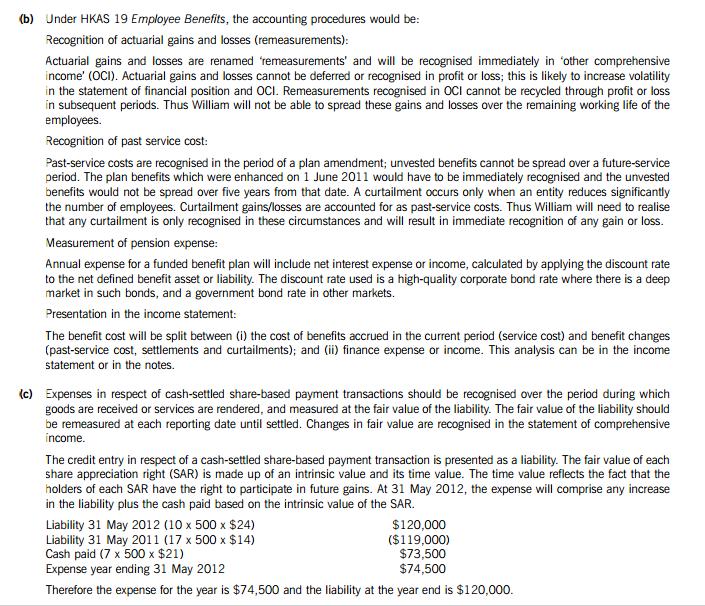

(b) William operates a defined benefit scheme for its employees. At June 2011, the net pension liability recognised

in the statement of financial position was $18 million, excluding an unrecognised actuarial gain of $15 million

which William wishes to spread over the remaining working lives of the employees. The scheme was revised on

1 June 2011. This resulted in the benefits being enhanced for some members of the plan and because benefits

do not vest for these members for five years, William wishes to spread the increased cost over that period.

However, part of the scheme was to be closed, without any redundancy of employees.

William requires advice on how to account for the above scheme under HKAS 19 Employee Benefits including

the presentation and measurement of the pension expense. (7 marks)

(d) William acquired another entity, Chrissy, on 1 May 2012. At the time of the acquisition, Chrissy was being sued

as there is an alleged mis-selling case potentially implicating the entity. The claimants are suing for damages of

$10 million. William estimates that the fair value of any contingent liability is $4 million and feels that it is more

likely than not that no outflow of funds will occur.

William wishes to know how to account for this potential liability in Chrissy’s entity financial statements and

whether the treatment would be the same in the consolidated financial statements. (4 marks)

Required:

Discuss, with suitable computations, the advice that should be given to William in accounting for the above

events.

Note: The mark allocation is shown against each of the four events above.

Professional marks will be awarded in question 2 for the quality of the discussion. (2 marks)

(25 marks)

5 [P.T.O.3 Ethan, a public limited company, develops, operates and sells investment properties.

(a) Ethan focuses mainly on acquiring properties where it foresees growth potential, through rental income as well

as value appreciation. The acquisition of an investment property is usually realised through the acquisition of the

entity, which holds the property.

In Ethan’s consolidated financial statements, investment properties acquired through business combinations are

recognised at fair value, using a discounted cash flow model as approximation to fair value. There is currently an

active market for this type of property. The difference between the fair value of the investment property as

determined under the accounting policy, and the value of the investment property for tax purposes results in a

deferred tax liability.

Goodwill arising on business combinations is determined using the measurement principles for the investment

properties as outlined above. Goodwill is only considered impaired if and when the deferred tax liability is reduced

below the amount at which it was first recognised. This reduction can be caused both by a reduction in the value

of the real estate or a change in local tax regulations. As long as the deferred tax liability is equal to, or larger

than, the prior year, no impairment is charged to goodwill. Ethan explained its accounting treatment by confirming

that almost all of its goodwill is due to the deferred tax liability and that it is normal in the industry to account

for goodwill in this way.

Since 2008, Ethan has incurred substantial annual losses except for the year ended 31 May 2011, when it made

a small profit before tax. In year ended 31 May 2011, most of the profit consisted of income recognised on

revaluation of investment properties. Ethan had announced early in its financial year ended 31 May 2012 that

it anticipated substantial growth and profit. Later in the year, however, Ethan announced that the expected profit

would not be achieved and that, instead, a substantial loss would be incurred. Ethan had a history of reporting

considerable negative variances from its budgeted results. Ethan’s recognised deferred tax assets have been

increasing year-on-year despite the deferred tax liabilities recognised on business combinations. Ethan’s deferred

tax assets consist primarily of unused tax losses that can be carried forward which are unlikely to be offset against

anticipated future taxable profits. (11 marks)

(b) Ethan wishes to apply the fair value option rules of HKFRS 9 Financial Instruments to debt issued to finance its

investment properties. Ethan’s argument for applying the fair value option is based upon the fact that the

recognition of gains and losses on its investment properties and the related debt would otherwise be inconsistent.

Ethan argued that there is a specific financial correlation between the factors, such as interest rates, that form

the basis for determining the fair value of both Ethan’s investment properties and the related debt. (7 marks)

(c) Ethan has an operating subsidiary, which has in issue A and B shares, both of which have voting rights. Ethan

holds 70% of the A and B shares and the remainder are held by shareholders external to the group. The

subsidiary is obliged to pay an annual dividend of 5% on the B shares. The dividend payment is cumulative even

if the subsidiary does not have sufficient legally distributable profit at the time the payment is due.

In Ethan’s consolidated statement of financial position, the B shares of the subsidiary were accounted for in the

same way as equity instruments would be, with the B shares owned by external parties reported as a

non-controlling interest. (5 marks)

Required:

Discuss how the above transactions and events should be recorded in the consolidated financial statements of

Ethan.

Note: The mark allocation is shown against each of the three transactions above.

Professional marks will be awarded in question 3 for the quality of the discussion. (2 marks)

(25 marks)

64 (a) The existing standard dealing with provisions HKAS 37, Provisions, Contingent Liabilities and Contingent Assets,

has been in place for many years and is sufficiently well understood and consistently applied in most areas.

Standard setters have felt it is time for a fundamental change in the underlying principles for the recognition and

measurement of non-financial liabilities. To this end, the International Accounting Standards Board (IASB) has

issued an Exposure Draft, ‘Measurement of Liabilities in IAS 37 Proposed amendments to IAS 37’. The Hong

Kong Institute of Certified Public Accountants has also invited its members and other interested parties to

comment on the exposure draft.

Required:

(i) Discuss the existing guidance in HKAS 37 as regards the recognition and measurement of provisions

and why standard setters feel the need to replace existing guidance; (9 marks)

(ii) Describe the new proposals that the IASB has outlined in the Exposure Draft. (7 marks)

(b) Royan, a public limited company, extracts oil and has a present obligation to dismantle an oil platform at the end

of the platform’s life, which is 10 years. Royan cannot cancel this obligation or transfer it. Royan intends to carry

out the dismantling work itself and estimates the cost of the work to be $150 million in 10 years time. The

present value of the work is $105 million.

A market exists for the dismantling of an oil platform and Royan could hire a third party contractor to carry out

the work. The entity feels that if no risk or probability adjustment were needed then the cost of the external

contractor would be $180 million in ten years time. The present value of this cost is $129 million. If risk and

probability are taken into account, then there is a probability of 40% that the present value will be $129 million

and 60% probability that it would be $140 million, and there is a risk that the costs may increase by $5 million.

Required:

Describe the accounting treatment of the above events under HKAS 37 and the possible outcomes under the

proposed amendments in the Exposure Draft. (7 marks)

Professional marks will be awarded in question 4 for the quality of the discussion. (2 marks)

(25 marks)

End of Question Paper

(b) (i) The basic rules for the derecognition model in HKFRS 9 Financial Instruments is to determine whether the asset under

consideration for derecognition is:

(i) an asset in its entirety, or

(ii) specifically identified cash flows from an asset (or a group of similar financial assets), or

(iii) a fully proportionate (pro rata) share of the cash flows from an asset (or a group of similar financial assets), or

(iv) a fully proportionate (pro rata) share of specifically identified cash flows from a financial asset (or a group of similar

financial assets).

Once the asset under consideration for de-recognition has been determined, an assessment is made as to whether the

asset should be derecognised. Derecognition is required if either:

(i) the contractual rights to the cash flows from the financial asset have expired, or

(ii) financial asset has been transferred, and if so, whether the transfer of that asset is subsequently eligible for

derecognition.

An asset is transferred if either the entity has transferred the contractual rights to receive the cash flows, or the entity

has retained the contractual rights to receive the cash flows from the asset, but has assumed a contractual obligation to

pass those cash flows on under an arrangement that meets the following three conditions:

(i) the entity has no obligation to pay amounts to the eventual recipient unless it collects equivalent amounts on the

original asset;

(ii) the entity is prohibited from selling or pledging the original asset (other than as security to the eventual recipient);

(iii) the entity has an obligation to remit those cash flows without material delay.

Once an entity has determined that the asset has been transferred, it then determines whether or not it has transferred

substantially all of the risks and rewards of ownership of the asset. If substantially all the risks and rewards have been

transferred, the asset is derecognised. If substantially all the risks and rewards have been retained, derecognition of the

asset is precluded. If the entity has neither retained nor transferred substantially all of the risks and rewards of the asset,

then the entity must assess whether it has relinquished control of the asset or not. If the entity does not control the asset

then derecognition is appropriate; however, if the entity has retained control of the asset, then the entity continues to

14recognise the asset to the extent to which it has a continuing involvement in the asset. Robby has transferred its rights

to receive cash flows and its maximum exposure is to repay $36 million. This is unlikely, but Robby has guaranteed

that it will compensate the bank for all credit losses. Additionally, Robby receives the benefit of amounts received above

$36 million and therefore retains both the credit risk and late payment risk. Substantially, all the risks and rewards

remain with Robby and therefore the receivables should still be recognised.

(ii) Manipulation of financial statements often does not involve breaking rules, but the purpose of financial statements is to

present a fair representation of the company’s or group’s position, and if the financial statements are misrepresented on

purpose then this could be deemed unethical. The financial statements in this case are being manipulated to hide the

fact that the group has liquidity problems. The Robby Group has severe problems with a current ratio of 044

($36m/$812m) and a gearing ratio of 083 ($53 + 20 + 21 + factored receivables 36 + land option 16 =

1136/equity interest including NCI $13609m). The sale and repurchase of the land would make little difference to the

overall position of the company, but would maybe stave off proceedings by the bank if the overdraft were eliminated.

Robby has considerable PPE, which may be undervalued if the sale of the land is indicative of the value of all of the

PPE.

Accountants have the responsibility to issue financial statements that do not mislead users as they assume that such

professionals are acting in an ethical capacity, thus giving the financial statements credibility. Accountants should seek

to promote or preserve the public interest. If the idea of a profession is to have any significance, then it must have the

trust of users. Accountants should present financial statements that meet the qualitative characteristics set out in the

Framework. Faithful representation and verifiability are two such concepts and it is critical that these concepts are

applied in the preparation and disclosure of financial information.

2 (a) A lease is classified as a finance lease if it transfers substantially the entire risks and rewards incident to ownership. All other

leases are classified as operating leases. Classification is made at the inception of the lease. Whether a lease is a finance

lease or an operating lease depends on the substance of the transaction rather than the form. Situations that would normally

lead to a lease being classified as a finance lease include the following:

the lease transfers ownership of the asset to the lessee by the end of the lease term;

the lessee has the option to purchase the asset at a price which is expected to be sufficiently lower than fair value at

the date the option becomes exercisable that, at the inception of the lease, it is reasonably certain that the option will

be exercised;

the lease term is for the major part of the economic life of the asset, even if title is not transferred;

at the inception of the lease, the present value of the minimum lease payments amounts to at least substantially all of

the fair value of the leased asset;

the lease assets are of a specialised nature such that only the lessee can use them without major modifications being

made.

In this case the lease back of the building is for the major part of the building’s economic life and the present value of the

minimum lease payments amounts to all of the fair value of the leased asset. Therefore the lease should be recorded as a

finance lease.

The building is derecognised at its carrying amount and then reinstated at its fair value with any disposal gain, in this instance

$15 million ($5m $35m) being deferred over the new lease term. The building is depreciated over the shorter of the lease

term and useful economic life, so 20 years. Finance lease accounting results in a liability being created, finance charge

accruing at the implicit rate within the lease, in this case 7%, and the payment reducing the lease liability in arriving at the

year-end balance. The associated double entry for the lease is as follows:

(d) HKAS 37 Provisions, Contingent Liabilities and Contingent Assets describes contingent liabilities in two ways. Firstly, as

reliably possible obligations whose existence will be confirmed only on the occurrence or non-occurrence of uncertain future

events outside the entity’s control, or secondly, as present obligations that are not recognised because: (a) it is not probable

that an outflow of economic benefits will be required to settle the obligation; or (b) the amount cannot be measured reliably.

In Chrissy’s financial statements contingent liabilities are not recognised but are disclosed and described in the notes to the

financial statements, including an estimate of their potential financial effect and uncertainties relating to the amount or timing

of any outflow, unless the possibility of settlement is remote.

However, in a business combination, a contingent liability is recognised if it meets the definition of a liability and if it can be

measured. The first type of contingent liability above under HKAS 37 is not recognised in a business combination. However,

the second type of contingency is recognised whether or not it is probable that an outflow of economic benefits takes place

but only if it can be measured reliably. This means William would recognise a liability of $4 million in the consolidated

accounts. Contingent liabilities are an exception to the recognition principle because of the reliable measurement criteria.

3 (a) The fair value model in HKAS 40 Investment Property defines fair value as the amount for which an asset could be exchanged

between knowledgeable, willing parties in an arm’s length transaction. Fair value should reflect market conditions at the date

of the statement of financial position. The standard gives a considerable amount of guidance on determining fair value; in

particular, that the best evidence of fair value is given by current prices on an active market for similar property in the same

location and condition and subject to similar lease and other constraints. Therefore investment properties are not being valued

in accordance with the best possible method. This means that goodwill recognised on the acquisition of an investment

property through a business combination of real estate investment companies is different as compared to what it should be

under HKFRS 3 Business Combination valuation principles. In reality, the fair value of both the property and the deferred tax

liability are reflected in the purchase price of the business combination. The difference between this purchase price and the

net assets recognised according to HKFRS 3, upon which deferred tax is based, is recognised as goodwill in the consolidated

statement of financial position.

16Ethan’s methods for determining whether goodwill is impaired, and the amount it is impaired by, are not in accordance with

HKAS 36 Impairment of Assets. The standard requires assets (or cash generating units (CGU) if not possible to conduct the

review on an asset by asset basis) to be stated at the lower of carrying amount and recoverable amount. The recoverable

amount is the higher of fair value less costs to sell and value in use. Fair value less costs to sell is a post-tax valuation taking

account of deferred taxes. According to HKAS 36, the deferred tax liability should be included in calculating the carrying

amount of the CGU, since the transaction price also includes the effect of the deferred tax and the purchaser assumes the tax

risk. Therefore, the impairment testing of goodwill should be based on recoverable amount, rather than on the relationship

between the goodwill and the deferred tax liability as assessed by Ethan.

Ethan should disclose both the methodology by which the recoverable amount of the CGU, and therefore goodwill, is

determined and the assumptions underlying that methodology under the requirements of HKAS 36. The standard requires

Ethan to state the basis on which recoverable amount has been determined and to disclose the key assumptions on which it

is based.

In accordance with HKAS 36, where impairment testing takes place, goodwill is allocated to each individual real estate

investment identified as a cash-generating unit (CGU). Periodically, but at least annually, the recoverable amount of the CGU

is compared with its carrying amount. If this comparison results in the carrying amount being greater than the recoverable

amount, the impairment is first allocated to the goodwill. Any further difference is subsequently allocated against the value of

the investment property.

The recognition of deferred tax assets on losses carried forward is not in accordance with HKAS 12 Income Taxes. Ethan is

not able to provide convincing evidence to ensure that Ethan would be able to generate sufficient taxable profits against which

the unused tax losses could be offset. Historically, Ethan’s activities have generated either significant losses or very minimal

profits; they have never produced large pre-tax profits. Therefore, in accordance with HKAS 12, there is a need to produce

convincing evidence from Ethan that it would be able to generate future taxable profits equivalent to the value of the deferred

tax asset recognised.

Any decision would be based mainly on the following:

history of Ethan’s pre-tax profits;

previously published budget expectations and realised results in the past;

Ethan’s expectations for the next few years; and

announcements of new contracts.

There have been substantial negative variances arising between Ethan’s budgeted and realised results. Also, Ethan has

announced that it would not achieve the expected profit, but rather would record a substantial loss. Additionally, there is no

indication that the losses were not of a type that could clearly be attributed to external events that might not be expected to

recur. Thus the deferred tax asset should not be recognised or at the very least reduced.

(b) Normally debt issued to finance Ethan’s investment properties would be accounted for using amortised cost model. However,

Ethan may apply the fair value option in HKFRS 9 Finanical Instruments as such application would eliminate or significantly

reduce a measurement or recognition inconsistency between the debt liabilities and the investment properties to which they

are related. The provision requires there to be a measurement or recognition inconsistency that would otherwise arise from

measuring assets or liabilities or recognising the gains and losses on them on different bases. The option is not restricted to

financial assets and financial liabilities. The HKICPA concludes that accounting mismatches may occur in a wide variety of

circumstances and that financial reporting is best served by providing entities with the opportunity of eliminating such

mismatches where that results in more relevant information. Ethan supported the application of the fair value option with the

argument that there is a specific financial correlation between the factors that form the basis of the measurement of the fair

value of the investment properties and the related debt. Particular importance was placed on the role played by interest rates,

although it is acknowledged that the value of investment properties will also depend, to some extent, on rent, location and

maintenance and other factors. For some investment properties, however, the value of the properties will be dependent on

the movement in interest rates.

Under HKFRS 9, entities with financial liabilities designated as FVTPL recognise changes in the fair value due to changes in

the liability’s credit risk directly in other comprehensive income (OCI). There is no subsequent recycling of the amounts in

OCI to profit or loss, but accumulated gains or losses may be transferred within equity. The movement in fair value due to

other factors would be recognised within profit or loss. However, if presenting the change in fair value attributable to the credit

risk of the liability in OCI would create or enlarge an accounting mismatch in profit or loss, all fair value movements are

recognised in profit or loss. An entity is required to determine whether an accounting mismatch is created when the financial

liability is first recognised, and this determination is not reassessed. The mismatch must arise due to an economic relationship

between the financial liability and the associated asset that results in the liability’s credit risk being offset by a change in the

fair value of the asset. Financial liabilities that are required to be measured at FVTPL (as distinct from those that the entity

has designated at FVTPL), including financial guarantees and loan commitments measured at FVTPL, have all fair value

movement recognised in profit or loss. HKFRS 9 retains the flexibility that existed in HKFRS 7 Financial Instruments:

Disclosures to determine the amount of fair value change that relates to changes in the credit risk of the liability.

(c) Ethan’s classification of the B shares as equity instruments does not comply with HKAS 32 Financial Instruments:

Presentation. HKAS 32 paragraph 11, defines a financial liability to include, amongst others, any liability that includes a

17contractual obligation to deliver cash or financial assets to another entity. The criteria for classification of a financial instrument

as equity rather than liability are provided in HKAS 32 paragraph 16. This states that the instrument is an equity instrument

rather than a financial liability if, and only if, the instrument does not include a contractual obligation either to deliver cash

or another financial asset to the entity or to exchange financial assets or liabilities with another entity under conditions that

are potentially unfavourable to Ethan. HKAS 32 paragraph AG29 explains that when classifying a financial instrument in

consolidated financial statements, an entity should consider all the terms and conditions agreed between members of a group

and holders of the instrument, in determining whether the group as a whole has an obligation to deliver cash or another

financial instrument in respect of the instrument or to settle it in a manner that results in classification as a liability. Therefore,

since the operating subsidiary is obliged to pay an annual cumulative dividend on the B shares and does not have discretion

over the distribution of such dividend, the shares held by Ethan’s external shareholders should be classified as a financial

liability in Ethan’s consolidated financial statements and not non-controlling interest. The shares being held by Ethan will be

eliminated on consolidation as intercompany.

4 (a) (i) The existing guidance requires a provision to be recognised when: (a) it is probable that an obligation exists; (b) it is

probable that an outflow of resources will be required to settle that obligation; and (c) the obligation can be measured

reliably. The amount recognised as a provision should be the best estimate of the expenditure required to settle the

present obligation at the balance sheet date, that is, the amount that an entity would rationally pay to settle the obligation

at the balance sheet date or to transfer it to a third party. This guidance, when applied consistently, provides useful,

predictive information about non-financial liabilities and the expected future cash flows, and is consistent with the

recognition criteria in the Framework. Standard setters have initiated a project to replace HKAS 37 for three main

reasons:

1. To address inconsistencies with other HKFRSs. HKAS 37 requires an entity to record an obligation as a liability

only if it is probable (i.e. more than 50% likely) that the obligation will result in an outflow of cash or other

resources from the entity. Other standards, such as HKFRS 3 Business Combinations and HKFRS 9 Financial

Instruments, do not apply this ‘probability of outflows’ criterion to liabilities.

2. To achieve global convergence of accounting standards. The IASB is seeking to eliminate differences between IFRSs

and US generally accepted accounting principles (US GAAP). At present, IFRSs and US GAAP differ in how they

treat the costs of restructuring a business.

3. To improve measurement of liabilities in HKAS 37. The requirements for measuring liabilities are unclear. As a

result, entities use different measures, making it difficult for analysts and investors to compare their financial

statements. Two aspects are particularly unclear. HKAS 37 requires entities to measure liabilities at the ‘best

estimate’ of the expenditure required to settle the obligation. In practice, there are different interpretations of what

‘best estimate’ means: the most likely outcome, the weighted average of all possible outcomes or even the

minimum or maximum amount in the range of possible outcomes. It does not specify the costs that entities should

include in the measurement of a liability. In practice, entities include different costs. Some entities include only

incremental costs while others include all direct costs, plus indirect costs and overheads, or use the prices they

would pay contractors to fulfil the obligation on their behalf.

(ii) The IASB has decided that the new IFRS will not include the ‘probability of outflows’ criterion. Instead, an entity should

account for uncertainty about the amount and timing of outflows by using a measurement that reflects their expected

value, i.e. the probability-weighted average of the outflows for the range of possible outcomes. Removal of this criterion

focuses attention on the definition of a liability in the Framework, which is a present obligation of an entity arising from

past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic

benefits. Furthermore, the new IFRS will require an entity to record a liability for each individual cost of a restructuring

only when the entity incurs that particular cost.

The exposure draft proposes that the measurement should be the amount that the entity would rationally pay at the

measurement date to be relieved of the liability. Normally, this amount would be an estimate of the present value of the

resources required to fulfil the liability. It could also be the amount that the entity would pay to cancel or fulfil the

obligation, whichever is the lowest. The estimate would take into account the expected outflows of resources, the time

value of money and the risk that the actual outflows might ultimately differ from the expected outflows.

If the liability is to pay cash to a counterparty (for example to settle a legal dispute), the outflows would be the expected

cash payments plus any associated costs, such as legal fees. If the liability is to undertake a service, for example to

decommission plant at a future date, the outflows would be the amounts that the entity estimates it would pay a

contractor at the future date to undertake the service on its behalf. Obligations involving services are to be measured by

reference to the price that a contractor would charge to undertake the service, irrespective of whether the entity is

carrying out the work internally or externally.

(b) Under HKAS 37, a provision of $105 million would be recognised since this is the estimate of the present obligation. There

will be no profit or loss impact other than the adjustment of the present value of the obligation to reflect the time value of

money by unwinding the discount.

18Under the proposed approach there are a number of different outcomes:

with no risk and probability adjustment, the initial liability would be recognised at $129 million which is the present

value of the resources required to fulfil the obligation based upon third-party prices. This means that in 10 years the

provision would have unwound to $180 million, the entity will spend $150 million in decommission costs and a profit

of $30 million would be recognised. If there were no market for the dismantling of the platform, then Royan would

recognise a liability by estimating the price that it would charge another party to carry out the service.

With risk and probability being taken into account, then the expected value would be (40% x $129m + 60% x $140m),

i.e. $1356m plus the risk adjustment of $5 million, which totals $1406 million.

$105 million being the present value of the future cashflows discounted.

The ED suggests within paragraph 36B that the entity should take the lower of:

(a) the present value of the resources required to fulfil the obligation, i.e. $105 million;

(b) the amount that the entity would have to pay to cancel the obligation, for which information is not available here; and

(c) the amount that the entity would have to pay to transfer the obligation to a third party, i.e. $1406 million incorporating

the administrative costs.

Therefore $105 million should be provided.

The ED makes specific reference to provisions relating to services such as decommissioning where it suggests that the amount

to transfer to a third party would be the required liability, so $1406 million would be provided.

相关推荐:

ACCA教材辅导讲义——Pilotpapers for F3

更多ACCA考试信息请关注读书人网(http://www.reader8.com/)

ACCA频道(http://www.reader8.com/exam/acca/)